Spinoff Instrument And Spinoff Market Features

Robust futures markets can contribute considerably to the institution of those benchmarks. They can all buy or promote gold contracts on a commodities change like the Multi Commodity Exchange of India (MCX). These contracts are standardized, so anyone can participate, and they’re regulated by the exchange.

While this technique will not be suitable for all traders, those that are keen to put in the effort and time to be taught it could profit tremendously from its benefits. By managing the gamma publicity of an options portfolio, merchants can generate constant income over time, even in volatile market situations. This is as a end result of the strategy permits traders to benefit from market movements while minimizing threat. Additionally, gamma-neutral trading might help traders to keep away from large losses, which can be detrimental to their total profitability. Trading PKR futures contracts has several advantages that make it a gorgeous selection for traders.

Advantages Of Gamma-neutral Trading[original Blog]

The change itself acts because the counterparty for every exchange-traded derivative transaction. It effectively becomes the seller for each purchaser, and the buyer for every vendor. This eliminates the chance of the counterparty to the spinoff transaction defaulting on its obligations. Exchange-traded derivatives have turn into more and more in style because of the benefits they have over over-the-counter (OTC) derivatives.

Over-The-Counter (OTC) options are tradable privately between people and have versatile terms and circumstances. On the other hand, exchange traded derivatives endure standardisation by market regulators and operate beneath strict guidelines. In the first half of 2021, the World Federation of Exchanges reported that a record 29.24 billion spinoff contracts had been traded on exchanges around the globe, up greater than 18% from the earlier period. In follow, many advanced hybrids of these models have developed over time, with parts of each of these structures.

- CLPs can help to scale back slippage by offering direct entry to liquidity swimming pools and matching orders in real-time.

- Alligator spreads are a kind of choice unfold where the dealer buys and sells three totally different choices with three completely different strike prices.

- These choices can be calls or places, and they’re all either purchased or offered on the similar time.

- Farmers used it to hedge in opposition to crop prices, and the exchange enabled them to enter into agreements for future supply at a predetermined worth.

- These contracts are marked-to-market at the finish of each year, which means that gains and losses are acknowledged for tax functions, even when the place continues to be open.

This is as a result of American-style choices could be exercised at any time earlier than the expiration date, which signifies that they offer greater flexibility to merchants. However, this flexibility comes at a value, as American-style options are generally more expensive than European-style options. As a end result, European-style options are sometimes seen as a more cost-effective alternative. Since dark pools allow for the execution of huge block trades without affecting the market, they can present a greater value for the trader. This is as a result of the trader can execute the complete commerce with out having to worry about slippage attributable to the market influence of their trade.

What Are Some Forms Of Derivatives Traded On An Exchange?

This is essential for merchants who want to benefit from market actions in real-time. By adjusting the portfolio’s gamma worth to zero, the dealer can benefit from completely different market situations. For example, if the market is experiencing high volatility, the trader can adjust the portfolio’s gamma value to zero and benefit from the volatility. On the opposite hand, if the market is experiencing low volatility, the trader can regulate the portfolio’s gamma worth to a optimistic or unfavorable value and benefit from the market circumstances.

Section 1256 contracts are topic to a particular tax rate, which is extra favorable than the charges for other types of investments. The benefits of trading worth channel breakouts are quite a few and might provide traders with important alternatives to capitalize on market movements. In this part, we are going to discover the benefits of buying and selling price channel breakouts from totally different angles.

What Is Your Current Monetary Priority?

HFT has a number of advantages, essentially the most significant of which is the power to execute trades rapidly and effectively. This signifies that merchants can take benefit of market alternatives faster than their competitors. Additionally, HFT may help scale back the bid-ask unfold, which makes trading cheaper for all market participants. However, HFT has also been criticized for the potential dangers it poses to financial stability, including the risk of market manipulation and the amplification of market volatility. Futures buying and selling is a well-liked funding option for merchants who’re looking for a method to diversify their portfolio and hedge against market risks.

It can also require a higher level of expertise and knowledge to trade successfully throughout multiple markets. When you commerce a quantity of foreign money pairs, you have larger flexibility in your trading technique. You can benefit from totally different buying and selling kinds and timeframes, and modify your technique to go well with the market conditions of each individual pair. For instance, you may choose to use a long-term trend-following technique for one pair, whereas using a short-term scalping technique for an additional. Euronext Frankfurt is subject to strict regulatory oversight, making certain that it operates in a fair, transparent, and environment friendly manner.

Advantages Of High-frequency Trading[original Blog]

As a end result, the relative prices and pay-offs faced by an trade seeking to draw liquidity from an OTC environment could have a big impact on general market structure. This implies that, in plenty of markets, there is a crucial coordination position for the trade in encouraging market individuals and end-users to make the transition. From a consumer perspective, it’s helpful to have a range of choices and selection to help meet the particular consumer needs. From a market design perspective, there are advantages in phrases of transparency, competition and worth discovery of the exchange mannequin.

In general, the lower the price of investing in a fund, the upper the expected return for that fund. Investors might wish to rapidly gain portfolio publicity to specific sectors, styles, industries, or nations but don’t have expertise in those areas. Given the extensive variety of sector, type, industry, and country classes obtainable, ETF shares may find a way to provide an investor straightforward publicity to a selected desired market phase. The main motivation for using derivatives is the transfer of danger from one get together to another. For instance, a transport company (long) would possibly use oil forwards to hedge towards the risk of rising gasoline prices, whereas an oil producer (short) would possibly use them to hedge against the risk of falling oil costs. FasterCapital is #1 on-line incubator/accelerator that operates on a global stage.

This implies that merchants can spend money on markets that they could not have access to in any other case. For instance, a dealer in the UK can invest in the US inventory market with out having to open a US brokerage account. Short promoting is the method of selling an asset that you don’t own, with the expectation that the price will lower. This means that traders can revenue from falling costs, as properly as rising costs.

Some derivatives are susceptible to counterparty defaults, particularly OTC contracts like forwards, European choices, and swaps. A default happens when one get together does not have the required capital to meet their obligations, which might end up in a loss for the other What is Exchange Traded Derivatives get together. The fashionable derivatives market started when the Chicago Board of Trade was founded in 1848. Farmers used it to hedge in opposition to crop prices, and the change enabled them to enter into agreements for future delivery at a predetermined price.

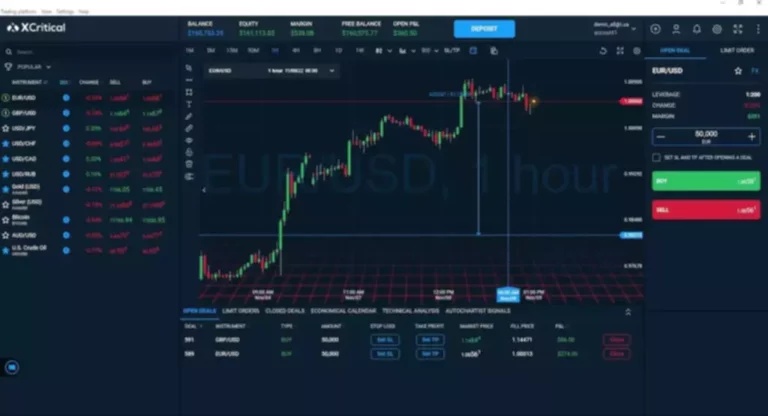

VIX futures and options are utilized by investors and merchants alike to hedge against market volatility, speculate on market actions, and generate income. In this part, we are going to explore some nice benefits https://www.xcritical.com/ of trading VIX futures and choices. Hedgers use trade traded derivatives to manage their financial dangers by offsetting their exposure to price actions within the underlying asset.

Speculators are market individuals who use ETDs to revenue from price movements within the underlying asset. An exchange-traded spinoff (ETD) is a monetary instrument that derives its value from an underlying asset, such as a commodity, a forex, or a stock index. Index choices are choices in which the underlying asset is a stock index; the Cboe presently presents choices on the S&P 500 and 100 indices, the Dow Jones, FTSE 100, Russell 2000, and the Nasdaq one hundred.